×

MB&T

Finance

Protect your savings beyond the traditional FDIC insurance limits.

With ICS®, the Intrafi Cash Service®, and CDARS®, you can work directly with MB&T to access millions in aggregate FDIC insurance across network banks.

Make funds eligible for protection that extends well beyond $250,000 and is backed by the full faith and credit of the federal government.

Feel good knowing that the full amount of funds placed through ICS and CDARS can support local lending opportunities that build a stronger community.1

Put excess cash balances to work by placing funds into money market accounts or CDs at rates set by MB&T.

Maintain access to your funds placed in demand deposit or money market accounts. With CD placements, select from multiple term options.

Work directly with MB&T―a bank you know and trust, to leverage the FDIC insurance of multiple banks to fully insure your deposits.

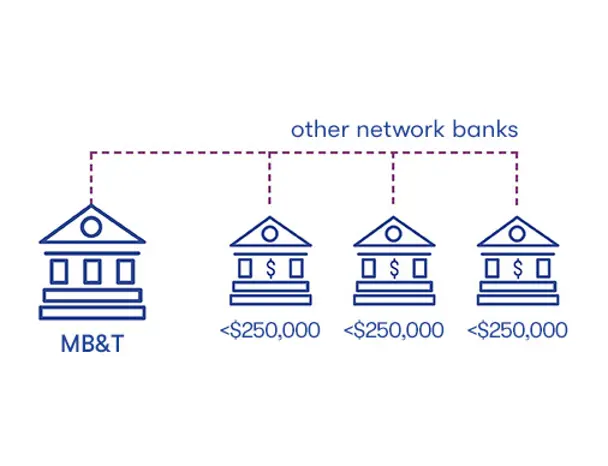

MB&T is a member of the Intrafi Network. When you place a large deposit with MB&T using the Intrafi Cash Service, that deposit is divided into amounts under the standard FDIC insurance maximum of $250,000 and is placed in deposit accounts at other FDIC-insured banks that participate in the same network.2

By working directly with MB&T, you can access multi-million-dollar FDIC insurance from many banks and enjoy the convenience of receiving just one statement for demand and savings placements and one for CDs.

As always, your confidential information is protected.

We're here to help.

Our MB&T Advisors team can help you define your goals and navigate your investment options with confidence.

Let's start a conversation.

Ready to explore? Here are some more great options we think you'll love.