×

MB&T

Finance

Supporting your mission from the beginning.

We understand the unique needs of nonprofit organizations. That's why we offer tailored checking account options that prioritize simplicity, flexibility and cost savings. Together, we can help you achieve your mission.

An interest checking account for nonprofits with low to moderate transaction activity.

An account for large volume nonprofits that provides a competitive earnings credit rate to offset activity fees.

Take your mission further with scalable Cash Management Packages that pair seamlessly with both of our nonprofit checking accounts. Each package combines essential cash management tools including ACH, Wires, Remote Deposit, and secure Business Online Banking to help you simplify donations, manage funds responsibly, and strengthen your organization’s financial operations. Choose the package that fits your organization and make managing your finances faster, easier, and more effective so you can stay focused on what matters most.

Say goodbye to checks and hello to faster payments!

Improve cash flow, automate payables, and scale smoothly.

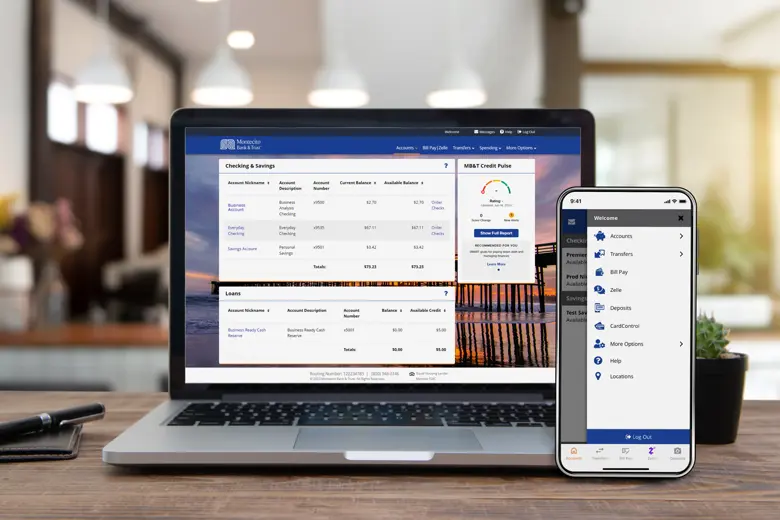

MB&T Business Online & Mobile banking is powerful, secure and user-friendly, giving you the control to check balances, transfer funds, make deposits, and pay bills from anywhere you're connected.

Whether you're looking for short term or long term financing - a BizMax Loan or Line of Credit may be the solution you're looking for.

Talk to a banker to get started.

We're here to help.

Ready to explore? Here are some more great options we think you'll love.