×

MB&T

Finance

Digital access. Rewarding benefits. Let's find the account that fits your needs.

We understand that one size doesn't fit all. Our accounts are designed with you in mind so you can control how to manage your money, all while having the convenience, efficiency, security and level of personal service you expect.

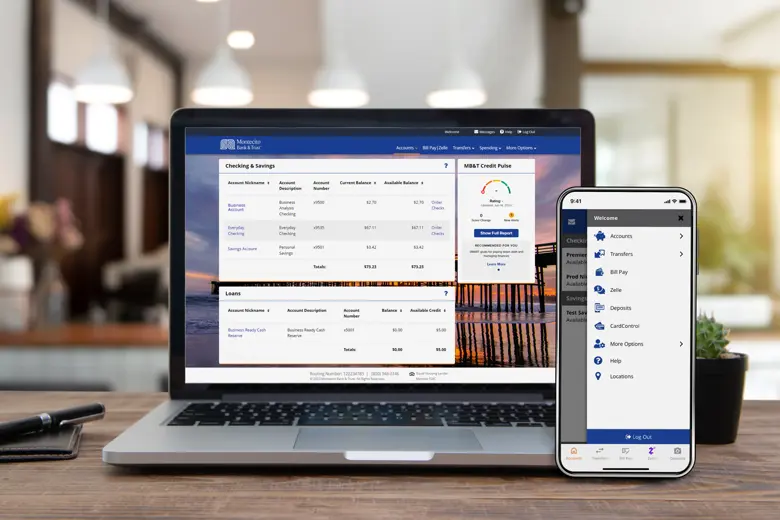

Powerful, secure, and user-friendly, MB&T Online and Mobile Banking gives you the control to check balances, transfer funds, make deposits and pay and receive money with Zelle® from anywhere you're connected.

Being prepared can be a very good thing. We have options to help you protect your account from overdrafts and give you the peace of mind that comes from knowing you're covered.

We're here to help.

Ready to explore? Here are some more great options we think you'll love.